Educational

Jan 15, 2026

SBA Set-Asides: What They Are and Why They Matter

Justin Zloty

Understanding the Strategic Purpose of SBIR

In federal contracting for small businesses, SBA set-asides refer to contracts that the government reserves exclusively for qualified small businesses or those in designated socio-economic categories. By limiting competition to only small firms, set-asides help level the playing field and enable small companies to win government contract opportunities that they might otherwise lose to larger corporations. In fact, U.S. policy mandates that a significant portion of federal contracting dollars be awarded to small businesses each year (23% or more), with specific targets for various socio economic groups. This is achieved through mechanisms like competitive set-asides and even sole source awards (contracts that can be directly awarded without competition) for eligible firms.

One key reason these set-asides matter is the “Rule of Two.” Under the SBA’s Rule of Two, if market research shows at least two small businesses can perform a contract at a fair price, the solicitation must be set aside for small businesses. Moreover, all federal acquisitions below the Simplified Acquisition Threshold (approximately $250k) are automatically set aside for small businesses by default. These policies ensure that small firms get a fair share of federal procurement and that agencies meet annual small business goals. Set-aside contracts thus channel billions of dollars of government contract opportunities to the small business community, fueling innovation and job growth.

Additionally, the SBA administers several socio-economic certification programs that enhance small business access to contracts. These include programs for businesses owned by disadvantaged individuals, women, service-disabled veterans, and those in underutilized areas. Government agencies have statutory goals for each category (for example, 5% of contract dollars to Women-Owned Small Businesses and 5% to Service-Disabled Veteran firms). By utilizing set-asides, agencies can achieve these targets, and small businesses in these groups get a foot in the door of federal contracting. In short, SBA set-asides are a cornerstone of federal contracting for small businesses, ensuring that large agencies invest in small business success and enabling newcomers to break into the federal market.

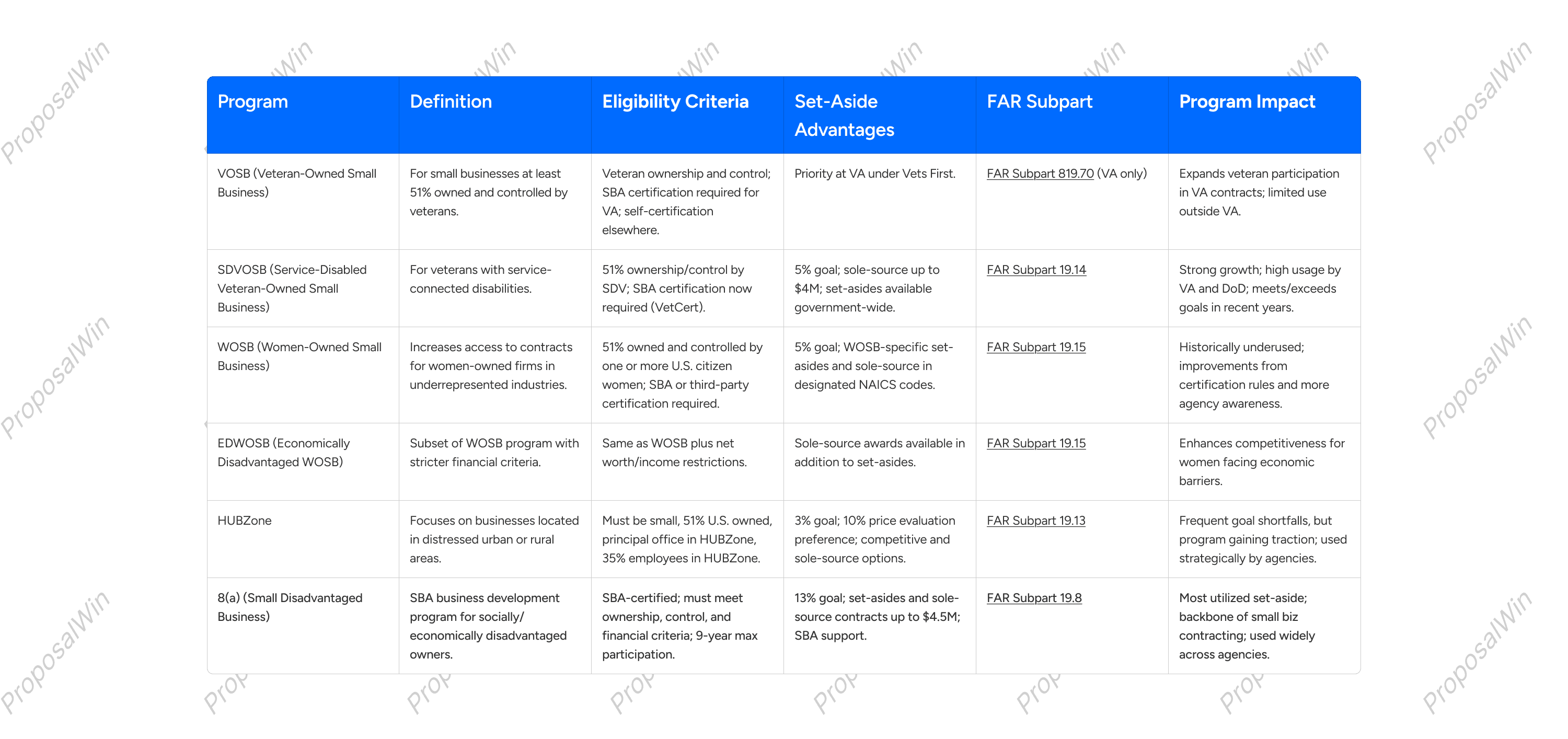

Overview of SBA Set-Aside Programs

Not all small businesses are the same. The SBA recognizes several categories of small businesses for set-aside contracts, each with its own eligibility criteria and unique benefits. The main SBA socio-economic set-aside programs are:

8(a) Business Development Program

The 8(a) Business Development Program is SBA’s flagship program for Small Disadvantaged Businesses (SDBs). It is a nine-year business development program created to help small firms owned by socially and economically disadvantaged individuals grow their capacity. Participants in the 8(a) program receive specialized training, counseling, and marketing assistance to compete more effectively in the federal marketplace.

A major benefit of 8(a) certification is access to exclusive contracts. Federal agencies can award 8(a) set-aside contracts that only 8(a)-certified firms can bid on, and they can even issue 8(a) sole-source contracts (up to $4.5 million, or $7 million for manufacturing) directly to an 8(a) firm without competition. This gives 8(a) companies a significant advantage in securing work. For example, an agency needing specialized services quickly can offer a sole-source contract to a vetted 8(a) firm, streamlining the acquisition process.

To qualify for 8(a), a business must be small and at least 51% owned and controlled by one or more individuals who are economically and socially disadvantaged (as defined by federal criteria). Participation is one-time only and limited to 9 years. The payoff for 8(a) firms can be substantial: the 8(a)/SDB category accounts for the largest share of small business contract dollars government wide. In FY 2024, small disadvantaged businesses (including 8(a) firms) won about $78.3 billion in federal prime contracts, underscoring the program’s importance in federal contracting.

HUBZone Program

The HUBZone Program targets small businesses in “Historically Underutilized Business Zones.” These are areas with high unemployment, low income, or other economic disadvantages. The pro gram’s goal is to stimulate economic development in these distressed urban and rural communities by incentivizing federal contracting with companies located there. The government aims to award at least 3% of contracting dollars to HUBZone-certified businesses each year.

To be HUBZone-certified, a firm must be small, at least 51% owned by U.S. citizens (or a community development corporation, an Indian tribe, etc.), have its principal office located in a designated HUBZone, and ensure that at least 35% of its employees reside in HUBZone areas. These requirements ensure the benefits of contracts flow to businesses that truly impact HUBZone communities.

HUBZone certification comes with valuable advantages. Federal agencies can set aside contracts exclusively for HUBZone firms. Additionally, HUBZone companies receive a 10% price evaluation preference in full-and-open contract competitions. This means if a HUBZone firm’s bid is within 10% of a non-small business’s bid, the HUBZone firm can be considered as if its bid were lower, helping them win awards even in competitions against larger firms. In FY 2024, HUBZone small businesses were awarded about $17.6 billion in contracts, though this fell slightly short of the 3% goal at around 2.75% of total federal spending. Still, the HUBZone program remains a key avenue for government contract opportunities in underrepresented areas.

Women-Owned Small Business (WOSB) Program

The Women-Owned Small Business Federal Contract Program is designed to expand the participation of women entrepreneurs in federal procurement. By law, the government strives to award at least 5% of prime contracting dollars to WOSBs each year. However, in many years that target was not met, indicating continued need for support: in FY 2024, WOSBs received roughly 4.97% of federal contract dollars (about $31.7 billion).

To qualify, a firm must be small and at least 51% owned and controlled by one or more women who are U.S. citizens. There is also a subset called Economically Disadvantaged WOSB (EDWOSB) for which the owners must meet certain personal net worth and income limits. Since 2020, WOSB certification is no longer self-certification; businesses must either go through SBA’s free certification process or an approved third-party certifier to be eligible for WOSB set-asides.

The WOSB program allows contracting officers to restrict competition to certified WOSBs (or EDWOSBs) for contracts in certain industries where women-owned firms have historically been underrepresented. These industries are identified by NAICS codes and updated periodically by SBA. Contracts can also be awarded on a sole-source basis to a WOSB/EDWOSB if only one qualified WOSB is available to fulfill the requirement, up to a ceiling (around $4-6.5 million, similar to 8(a) thresholds). By leveraging the WOSB program, agencies create government contract opportunities specifically for women entrepreneurs, helping to chip away at the historic disparity in federal awards. For women-owned businesses, obtaining WOSB certification and searching within designated industries for WOSB set-aside solicitations is a proven strategy to increase chances of winning federal contracts.

Service-Disabled Veteran-Owned Small Business (SDVOSB) Program

The SDVOSB program aims to honor the service of disabled veterans by helping them become successful entrepreneurs. The government-wide goal for contract awards to Service-Disabled Veteran-Owned Small Businesses is at least 5% of federal contracting dollars. In FY 2024, SD VOSBs received about 5.14% of contract dollars, totaling $32.8 billion, achieving the target for the first time since the goal was raised from 3% to 5% by recent legislation.

To be eligible, a small business must be at least 51% owned and controlled by one or more service-disabled veterans. The veteran owner(s) must have a disability connected to their military service, as determined by the Department of Veterans Affairs (VA) or Department of Defense. As of January 2023, the SBA now manages all certifications for veteran-owned businesses through the Veteran Small Business Certification (VetCert) program, which means SDVOSBs must formally certify with SBA to compete for set-asides (self-representation is no longer sufficient).

Under the SDVOSB program, agencies can create set-aside competitions only for SDVOSBs, and can award sole-source contracts up to $4 million (or $7 million for manufacturing) when there is just one qualified SDVOSB available. Notably, the Department of Veterans Affairs has a unique “Vets First” authority: it gives preference to Veteran-Owned and SDVOSB firms for VA contracts, backed by law and court decisions that require VA to apply the Rule of Two for veterans first. Outside the VA, SDVOSB firms still benefit from government-wide set-asides across all agencies. Achieving SDVOSB certification and marketing that status can open doors to many federal contract opportunities that might otherwise have heavy competition.

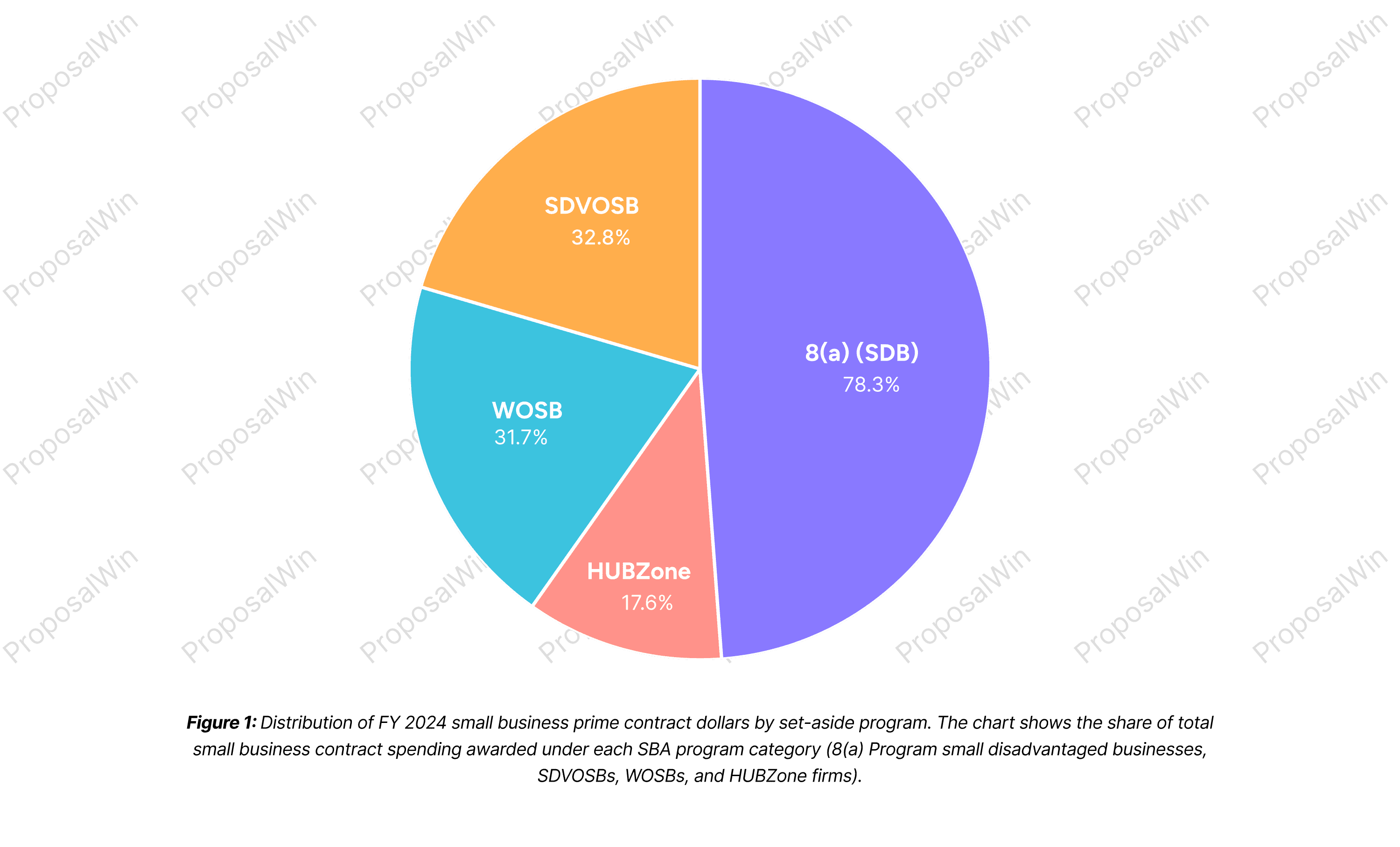

FY 2024 Federal Contracting Highlights for Small Businesses

FY 2024 was a record-breaking year for small business participation in federal contracting. According to the Small Business Administration’s procurement scorecard, the federal government awarded approximately $183.5 billion in prime contracts to small businesses during the fiscal year. That figure represents about 28.8% of all federal contracting dollars, significantly exceeding the statutory 23% small business goal. Put simply, more than one out of every four dollars the federal government spent on contracts in FY 2024 went to a small business, an outcome that underscores how meaningful SBA set-aside programs have become in practice.

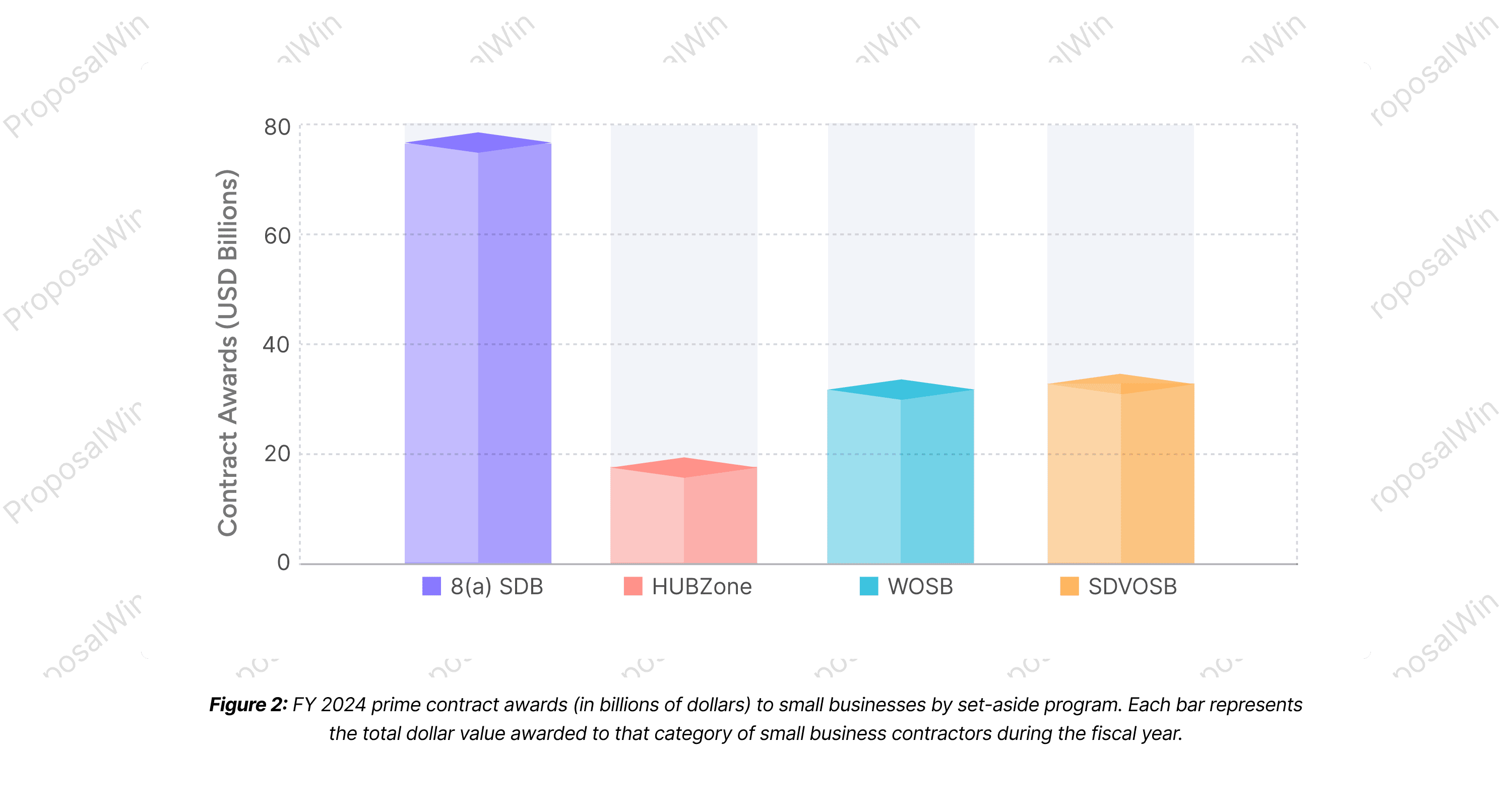

Breaking down that $183.5 billion among the major SBA categories:

Small Disadvantaged Businesses (including 8(a) firms): Within that total, Small Disadvantaged Businesses accounted for roughly $78.3 billion in contract awards, or about 12.3% of total federal spending. This category includes firms participating in the 8(a) Business Development Program, meaning all 8(a) awards are captured within the broader SDB figure. While FY 2024 represented an all-time high in dollar value for disadvantaged businesses, the total still fell slightly short of the government’s 13% aspirational goal for SDB participation. It is also worth noting that the term “Super 8(a),” which is sometimes used in industry conversations, is not a formal SBA classification. Instead, it refers informally to the higher-dollar sole-source authorities available within the existing 8(a) program when specific thresholds and justifications are met.

Service-Disabled Veteran-Owned Small Businesses (SDVOSB): SDVOSBs saw a particularly strong year, receiving approximately $32.8 billion in federal contract awards. This equated to about 5.14% of total federal contracting dollars and marked the first time the raised 5% SDVOSB goal was fully met on a government-wide basis. Veteran-Owned Small Businesses more broadly include both service-disabled and non-service-disabled veteran firms. While VOSBs are tracked in federal procurement data, only SDVOSB awards count toward a statutory SBA prime contracting goal, except in Department of Veterans Affairs procurements, where veteran preferences are applied separately.

Women-Owned Small Businesses (WOSB): WOSBs were awarded approximately $31.7 billion in prime contracts in FY 2024, representing about 4.97% of total federal contracting dollars. Once again, this came just shy of the 5% WOSB goal, continuing a pattern seen over many prior fiscal years. Within this category, Economically Disadvantaged Women-Owned Small Businesses are a defined subset, meaning all EDWOSB awards are included within the broader WOSB total. EDWOSBs do not have a separate government-wide percentage goal; rather, the distinction allows agencies to use additional sole-source and set-aside authorities when certain conditions are met.

HUBZone Small Businesses: HUBZone small businesses received approximately $17.6 billion in federal contract awards, accounting for about 2.75% of total contracting dollars. Although this fell below the 3% HUBZone goal, the total dollar value increased compared to prior years, signaling continued growth and agency engagement in geographically targeted small business contracting.

Taken together, the FY 2024 numbers demonstrate that SBA set-aside programs are far more than policy objectives on paper. They direct substantial federal spending and create real, repeatable opportunities for small businesses that understand how these programs work and how they overlap. For contractors, the takeaway is clear: selecting the right certifications, understanding which goals agencies are under pressure to meet, and aligning proposals accordingly can materially affect competitiveness in the federal marketplace.

These categories collectively account for the majority of small business contracting dollars. The remainder of small business awards went to firms that are small but do not fall into one of the above specific subcategories (often simply referred to as “other” small businesses).

Figure 2 presents the dollar values awarded to each category in a bar chart format for easy comparison.

As shown above, small disadvantaged businesses in the 8(a) program captured the largest piece of the pie. HUBZone firms, while receiving a smaller share, still obtained nearly 10% of the small business dollars. This visual emphasizes how critical the 8(a)/SDB and other socio-economic programs are in driving opportunities for small businesses.

In total, FY 2024 was a banner year for small business contracting. It set a new record in dollars awarded, demonstrating the effectiveness of set-aside programs in channeling work to small firms. However, the results also highlight areas for improvement: some goals (like WOSB and HUBZone) were not fully met, suggesting that agencies may increase efforts in those categories moving forward. Small businesses entering the federal market in FY 2025 and beyond can take heart that agencies have a strong incentive to contract with them, backed by both policy goals and positive trends in recent spending.

Leveraging SBA Set-Asides to Win Contracts

Participating in SBA set-aside programs can significantly boost a small business’s chances of winning federal contracts, but success still requires strategy and effort. Here are some actionable tips to best leverage these programs and turn your certifications into contract wins:

Get Certified and Stay Current

Ensure your business obtains all relevant SBA socio-economic certifications (8(a), HUBZone, WOSB, SDVOSB) that you qualify for. Use the SBA’s Certify website to apply and keep your certification active (e.g. WOSBs must undergo annual attestation, HUBZones recertify every 3 years, etc.). You can’t bid on set-aside contracts until your certification is in place, so this is step one.

Update Your SAM Profile with Keywords

When registered in SAM.gov, make sure your small business profile clearly indicates your certifications and small business statuses. Government buyers often search the SBA’s Small Business Dynamic Search database to find qualified vendors. Include keywords like “8(a) certified,” “HUBZone small business,” “WOSB,” or “SDVOSB” in your capability narrative so that acquisition officials can easily identify your company for set-aside opportunities.

Research Set-Aside Opportunities

Proactively search for contract notices that are designated for small businesses or your socio-economic category. On SAM.gov, you can filter opportunities by set-aside type (e.g. Total Small Business, WOSB, etc.). Focus on those government contract opportunities where competition is limited to businesses like yours; your odds of winning are much higher in a smaller pool of bidders. Also monitor agency procurement forecasts and small business offices (OSDBU) for upcoming set-asides. If an agency is falling short on, say, HUBZone awards or WOSB goals, they may have more set-asides forthcoming to make up ground.

Market Your Certifications

Don’t assume “if you build it, they will come.” Actively market your status as an SBA-certified firm. Mention it in all your collateral (Capability Statements, website, business cards) and during networking events or industry days. Reach out to agency Small Business Specialists and let them know you are certified and ready to perform: they might consider a direct award or include you in a limited-source solicitation. Agencies get credit towards their goals for awarding to certified firms, which can be a selling point in your favor.

Leverage Sole-Source Authorities

If you identify a specific agency need that your product or service can fulfill, remember that 8(a), HUBZone, SDVOSB, and WOSB programs all have sole-source contract options. For instance, 8(a) firms can receive sole-source awards up to $4.5M; HUBZone and SDVOSB sole-sources are also possible up to $4M. While you generally can’t force an agency to sole-source to you, you can market to program managers and contracting officers and highlight that awarding to your firm can be done quickly under those authorities. This can be particularly effective for urgent requirements or end-of-year needs.

Build Past Performance Through “Quick Win” Contracts

Don’t overlook smaller contracts as stepping stones. Micro-purchases (credit card buys under $10k) and simplified acquisitions (¡$250k) are often set aside for small businesses and involve minimal paperwork. Winning a few of these can build your track record. Similarly, consider subcontracts with larger primes to get experience on federal projects. By focusing on these lower-barrier opportunities, new entrants can rapidly gain credibility and past performance, positioning themselves for bigger set-aside contracts down the road.

Team Up Strategically

If a contract is too large or complex for your company alone, use teaming arrangements or joint ventures to compete. Under SBA’s rules, a joint venture consisting of a small business (or one with the relevant certification) can qualify for set-aside contracts as long as the joint venture agreement meets SBA requirements. Through the Mentor-Protege Program, you can even joint venture with a large mentor company and still be treated as a small business for an award. Teaming with other companies (small or large) can expand your capabilities, allowing you to pursue larger opportunities while still leveraging set-aside status. Just be sure to follow the SBA’s joint venture guidelines to protect your eligibility.

Use SBA and Veterans’ Resources

Lastly, tap into the free resources available. The SBA offers training, counseling, and matchmaking through local offices and partners (such as Procurement Technical Assistance Centers, now called APEX Accelerators). These experts can help you navigate registrations, find opportunities, and even review proposals. If you are a veteran-owned business, the VA’s Vets First program and Veteran Business Outreach Centers can provide additional guidance specific to winning contracts in the veteran community. In summary, you are not alone; plenty of support exists to help small businesses succeed in federal contracting.

By following these steps, a small business can maximize the advantage of SBA set-asides. Remember that set-aside certifications are not a guarantee of contracts, but they are powerful

tools. When combined with diligent marketing, competitive pricing, and good performance, these programs give you a foot in the door to the vast federal marketplace that large competitors won’t have. Start small, focus on your niche and socio-economic strengths, and gradually build on each success. With the federal government spending hundreds of billions each year on small business contracts, there are ample opportunities for those who position themselves well. SBA set-asides exist to ensure that America’s small businesses can thrive in federal contracting, and with the right approach, your company can be the next success story.

Additional Resources

(All images are produced and owned by ProposalWin)

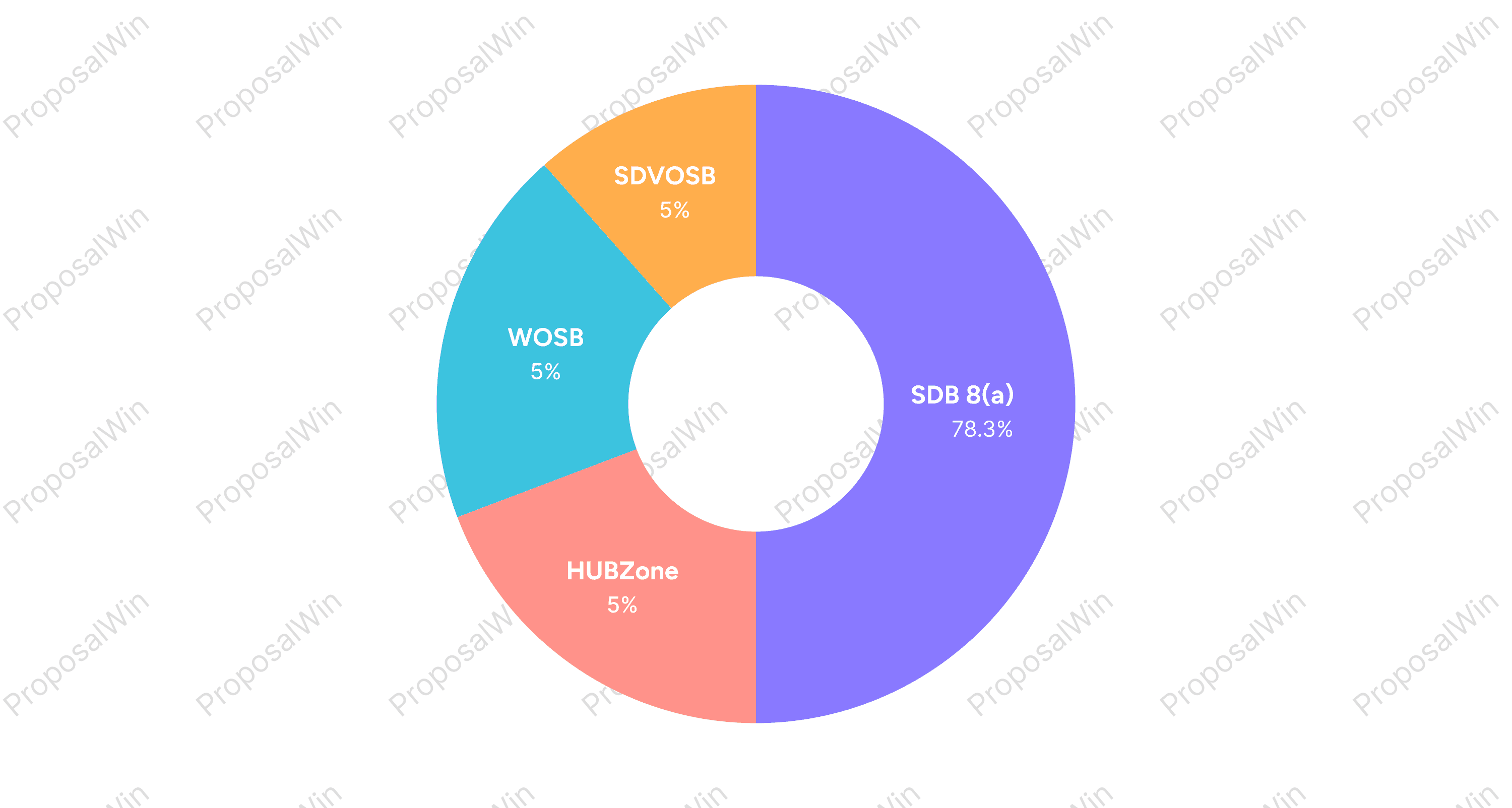

Target Budget Allocation by SBA Set-Aside Category

This pie chart shows the U.S. federal government's statutory contracting goals by SBA set-aside program:

13% to Small Disadvantaged Businesses (8a), 5% each to Women-Owned and Service-Disabled Veteran-

Owned Small Businesses, and 3% to HUBZone-certified firms.

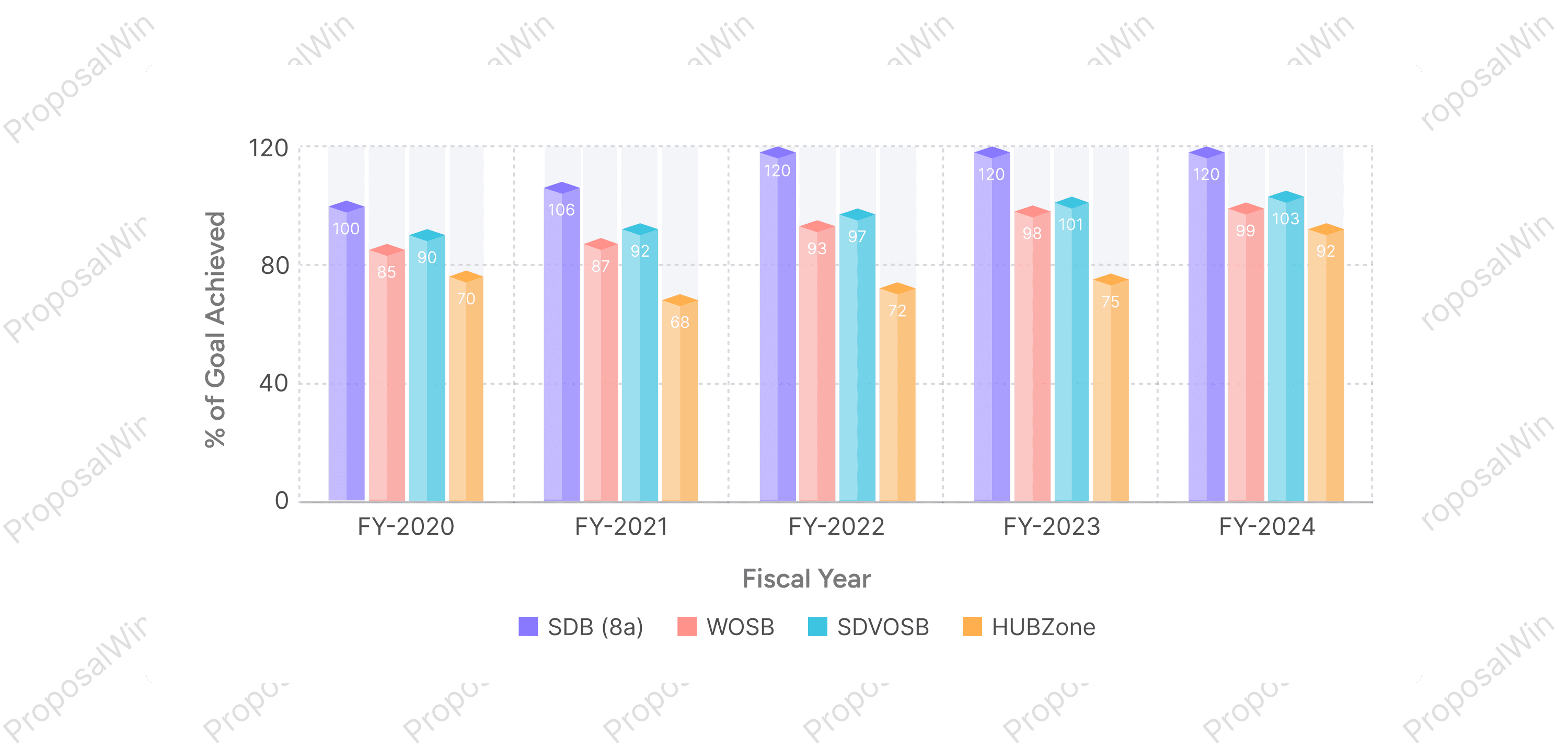

Historical Goal Achievement by Set-Aside Program (FY2020-FY2024)

This grouped bar chart illustrates which SBA set-aside programs met or fell short of their government

contracting goals between FY2020 and FY2024. Values exceeding 100% indicate categories that exceeded

their goal. HUBZone and WOSB programs frequently underperformed.

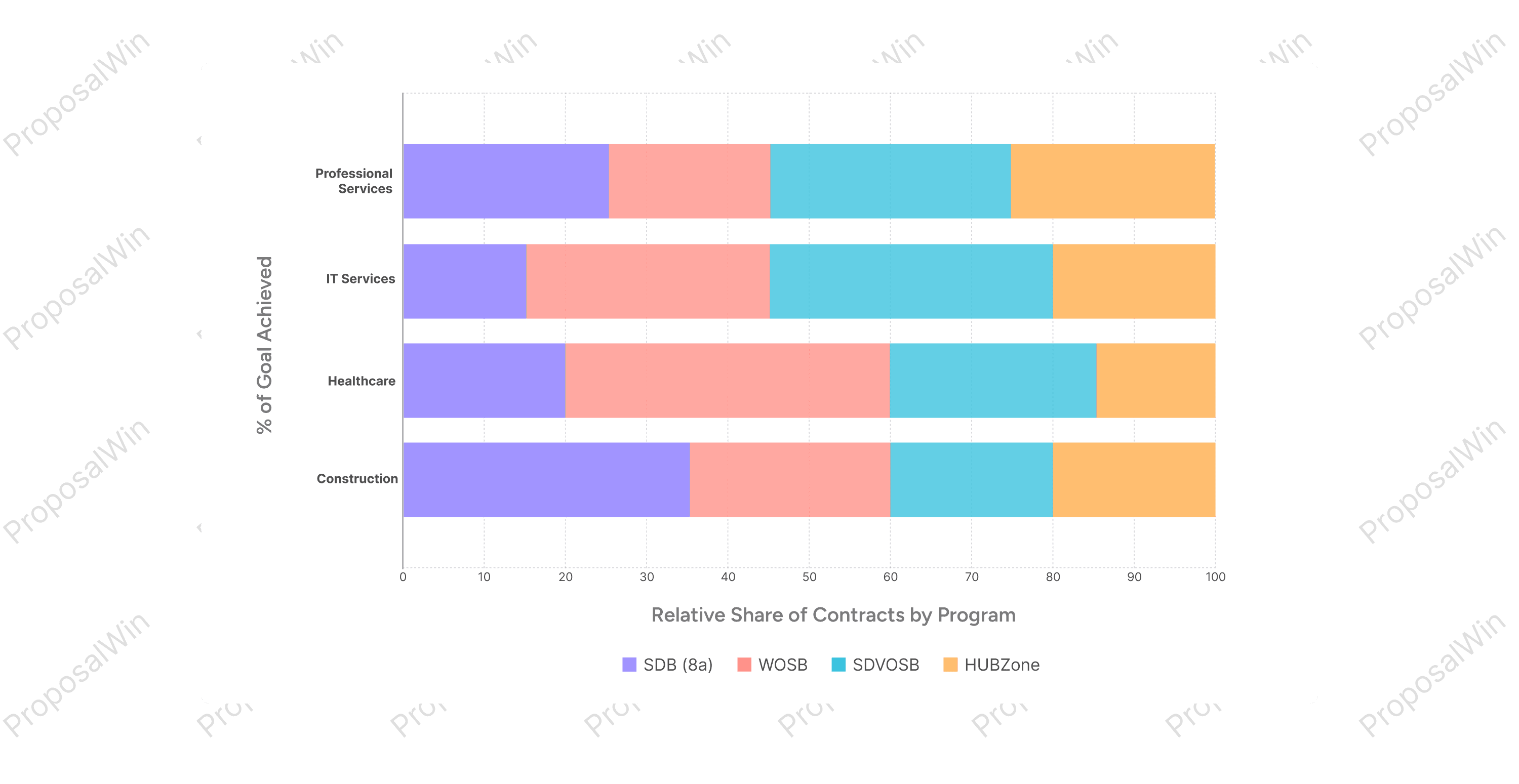

Industry Relevance by SBA Program (Illustrative)

This illustrative horizontal bar chart estimates which industries are most active for each SBA set-aside

category. For instance, 8(a) and HUBZone awards are more common in construction, while WOSB and

SDVOSB contracts tend to appear more in healthcare and IT.

Ready to Submit Stronger, Fully Compliant Proposals?

Join the agencies and contractors who trust ProposalWin to deliver faster, better, compliant proposals, and see how much smoother your next bid can be.